We think HSAs are great

A Health Savings Account (HSA) is a tax advantaged savings account available for anyone with HSA-eligible health insurance. Money contributed to this account is designated for medical spending. Contributions are tax deductible and yours forever. Even better, you can invest and grow it, tax free.

More about Health Savings Accounts

While Health Savings Accounts (HSA) offer a bunch of benefits, you have to play by the rules. Here is some additional information about how they work.

- Must have a qualified health insurance plan (HDHP) to contribute to an HSA

- You don't pay tax on HSA contributions

- The HSA acts as a separate investment account in your name

- Invest your HSA in cash, stocks, bonds, ETF's, and other instruments

- You own the money forever, regardless of employer; no "use it or lose it"

- Generally, withdrawals must be spent on medical expenses

- However, after age 65 you may use your HSA however you like, tax free

Basically, it is your own tax advantaged savings account designated for medical purposes. Instead of paying for medical care with dollars that have been taxed, you pay with pretax dollars which effectively gives you a discount on medical expenses equal to your tax rate. The money you contribute remains yours forever, even if you change insurance employers or insurance.

IRS requirements for Health Savings Accounts

In order to reap the benefits of an HSA, you have to play nicely with the IRS. The key is to keep all transactions that affect your HSA up to date, and that is what TrackHSA helps you accomplish. Each year, at tax time you must:

- Know how much you contributed to your HSA

- Know how much you withdrew from your HSA

- Prove to the IRS that withdrawals were for qualified medical expenses

In order to use tax-free money for medical expenses, the IRS requires that you can prove that HSA funds were spent on qualified medical expenses. This prevents people from taking advantage of the system.

How TrackHSA.com fits in

TrackHSA helps you meet the IRS record keeping requirements in three main ways:

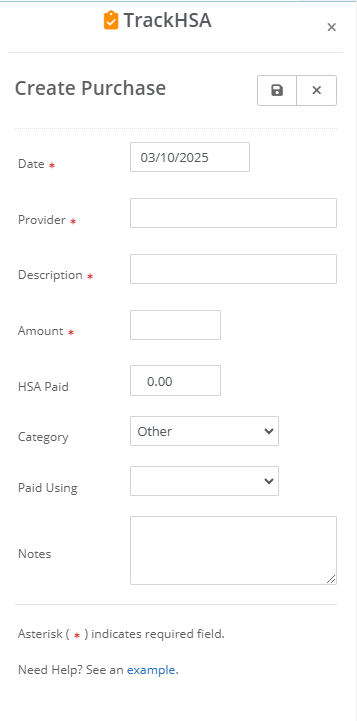

Recording Purchases

When you record an HSA transaction, TrackHSA guides you with required fields to ensure it is properly documented. One such field is the HSA Category field, which contains a list of qualified medical expenses per the IRS. Classifying your purchase using one of the options validates that your use of HSA funds is appropriate.

Upload Receipts

This is a critical step. By uploading a copy of the receipt from your HSA purchase, you document proof that you purchased a qualified medical expense for a given dollar amount. Doing so justifies your HSA purchase and audit proofs you should the IRS come knocking. As you employ more advanced HSA strategies, you will want to keep this proof around for a long time.

Track Reimbursements

Not all of your HSA spending will be paid by your Health Savings Account. You might instead use cash, check, credit or debit card at the point of sale. In these cases where the purchase was for a qualified medical expense, you are allowed to reimburse yourself later. This effectively pays for the service with pre-tax HSA dollars after the fact. You simply transfer funds from your HSA to another account owned by you for the amount of the medical expense.

Why would you want to do this? See the advanced section, but this allows you to 1) keep money in your HSA that you can 2) invest and 3) grow tax free.

TrackHSA clearly tracks what purchases are due for reimbursement. Once you decide to reimburse yourself, simply update that transaction to reflect the reimbursement amount. You can even add a note to include the details. Knowing which purchases have not been reimbursed prevents you from overpaying taxes and allows for Advanced HSA Strategies, below.

Lower your taxes with an HSA

Health Savings Accounts lower your taxable income for a given year, since HSA contributions are not taxed. This mechanism can occur in two ways:

- If you contribute through your employer, contributions are deducted from your paycheck before taxes are applied, so they avoid being taxed.

- If you make manual contributions to your HSA, you contribute taxed dollars but you remove these contributions from your taxable income when you file your taxes. This lowers the amount of tax you pay, often by means of a refund.

A real-world tax example

For example, the maximum HSA contribution (family) for 2025 is $8,550. Suppose you have a tax rate of 22%. Without an HSA, that $8,550 is earned and taxed as normal income at 22%, so you pay $1,881 in taxes. You keep the remaining $6,669.

Using an HSA, you shelter this $8,550 so that you keep 100% of it. Instead of having $6,669, you keep the entire $8,550 in your HSA account to use for medical expenses or retirement. You can even invest that account to grow it over time. All tax free.

The HSA's Triple Tax Advantage

The Health Savings Account is famed for its "Triple Tax Advantage" which makes it, arguably, the most powerful investment vehicle out there. It offers 3 distinct tax advantages for funds in the account:

- Contributions are made tax free

- Earnings grow tax free

- Withdrawals (for medical expenses, or anything after age 65) are tax free

Advanced HSA Strategies

Here are a few of the advanced strategies that TrackHSA can help you employ to get the most out of your HSA:

Save on Medical Costs

This is the main benefit that everyone receives by paying for medical services with their HSA. As discussed above, not paying taxes on your HSA contributions means there are more dollars in your account, so medical costs are cheaper roughly by your tax rate (e.g. 22% discount). This savings adds up year after year, and as you'll see below, any funds in your HSA at age 65 can be withdrawn penalty free (i.e. used for that 2nd home in retirement).

Reduce Your Taxable Income

Contributing to your HSA de facto reduces the amount of taxes you will pay in a given year. If you are earning $75k with no HSA, you are paying tax on the full $75k. However, if you have an qualified HDHP you can open an HSA, contribute $4,300, and only pay taxes on $70,700 of income, resulting in a smaller tax burden.

This allows you to keep more money and pay less taxes. Your HSA contribution will certainly come in useful, as you use it for future medical expenses or even retirement. Best of all, it can be invested along the way so it can grow and compound year over year.

Create a Rainy Day Fund

HSA qualified purchases do not need to be initially paid with your actual HSA account. Instead, you can pay for them with your regular credit / debit card and reimburse yourself later from your HSA. That transfer effectively pays for the service with your HSA (e.g. tax free dollars). However, delaying this reimbursement is a powerful strategy that can provide you flexibility. Having a reimbursement tracked in TrackHSA means you can pull this money from your HSA at any time. Should you need it, you have this cash at your disposal.

Your HSA acts as a source of funds, where you can withdraw from it at any time to reimburse yourself for prior qualified purchases not-yet-reimbursed. You can then use this money for whatever you want, a large purchase, expense, or investment. Doing so gives you flexibility and access to liquidity or capital.

Tax Free Investment

Following the prior example, while you can reimburse prior purchases at any time, you can choose to keep those dollarsin your HSA. Why would you want to keep that money unreimbursed in your HSA? The answer is if you are investing all or part of your HSA balance, that money is growing, tax free. If you take a long term approach, it is better to let that untouched, tax-free capital grow and compound over the years than to pull it out to pay for a medical transaction, nipping that growth in the bud. Of course this is not always possible, but the advanced strategy is to "protect" that tax free capital (equal to your HSA contribution), invest it, and let it grow. That will pay dividends down the line as the law of compounding does its magic.

Save for Retirement

While HSA's are primarily medical savings accounts, they are treated like Individual Retirement Accounts (IRA) according to the IRS. At age 65, you can use your HSA for anything (including non-medical expenses) penalty free. This means that you can go years saving in your HSA, using it for qualified medical expenses as needed, and when you turn 65, repurpose those HSA funds for whatever you like. Like non-qualified withdrawals, you will need to pay tax on distributions (since you never paid income tax on the money), but all of those earnings from investment grew tax free. This is similar to how an IRA works - either you pay tax up front and contribute (Roth), or contribute and pay tax on withdrawal (traditional IRA).